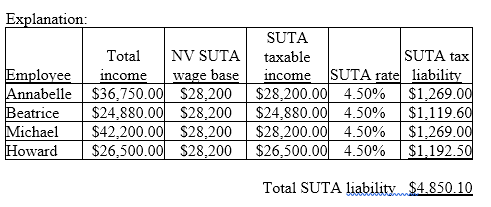

PCD Inc. operates as a Nevada business. The SUTA wage base for Nevada is $28,200. PCD Inc.'s SUTA tax rate is 4.5%. The employees' annual earnings for the past calendar year are as follows: Annabelle $36,750, Beatrice $24,880, Michael $42,200, Howard $26,500. What is PCD Inc.'s SUTA tax liability for the year?

A) $5,864.85

B) $4,850.10

C) $6,037.82

D) $4,733.72

B) $4,850.10

You might also like to view...

Apple Company had terms of net 60 days for customers. The number of days' sales in accounts receivable for Apple was 42 days. Apple is efficient in the collection of its receivables

a. True b. False Indicate whether the statement is true or false

A scale that has description also has order

Indicate whether the statement is true or false

Merve has just witnessed her good friend steal from the company where they have worked for the past 10 years. She is worried about saying something because she knows that her friend is going through a tough time and she does not want her to lose her job. On the other hand, she is worried about her company going under, which would result in the loss of jobs for even more people. Merve is struggling with a/an ______.

A. social quandary B. ethical dilemma C. wicked problem D. moral dilemma

How does Michael Shermer characterize the current state of humanity in terms of ethics?

a. the most moral period in our collective history b. in a slight state of decline over the last 50 years c. under serious threat from technology during the 21st century d. in a steep decline due to fraying communal values