Which sentence uses idiomatic expressions appropriately?

A) Our clinic must comply to government regulations for the disposable of all medical supplies.

B) Marcella has an appreciation of Italian art history.

C) All students must adhere to the college's netiquette policy.

C

You might also like to view...

Brady knows that the brakes on his car do not work, but he tells Celia, a potential buyer, that there are no problems with the car. On this assurance, Celia buys the car. On learning the truth, she may sue Brady for A) trade libel

B) conversion. C) ?fraudulent misrepresentation. D) no tort.

The proposal should include a lengthy, detailed list of activities to show planning has been well thought out by the contractor

a. True b. False Indicate whether the statement is true or false

A guaranteed payment may be designed to compensate a partner for personal services rendered to the partnership.

Answer the following statement true (T) or false (F)

Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2018.

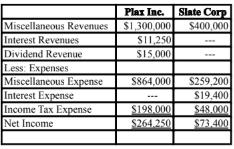

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the

straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

What will be an ideal response?