Given that shares are riskier than bonds, why do investors invest in equity?

What will be an ideal response?

Equity investors are rewarded for taking on higher risk with an average rate of return that is greater than the average rate of return on bonds. Although equity returns fluctuate from year to year, investors who are willing to bear the additional risk of investing in shares also benefit from a higher average return.

A-head: INVESTMENT RETURNS

Concept: Risk

You might also like to view...

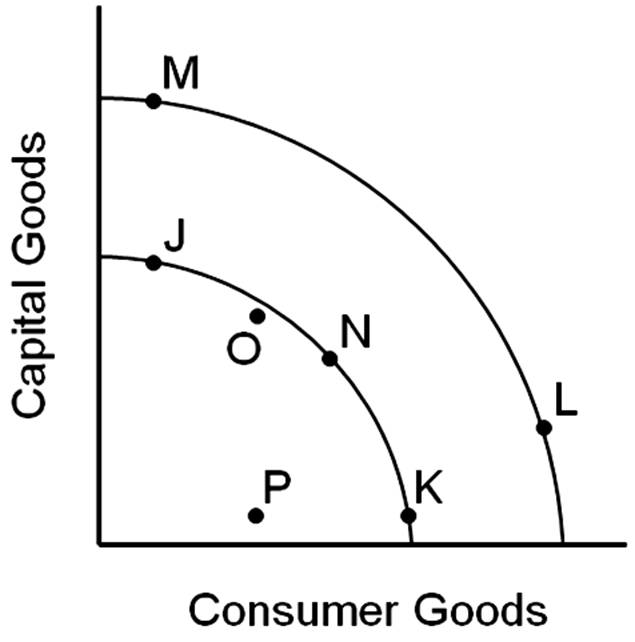

The opportunity cost of a movement from point N to J would

A. be the lost production of some capital goods.

B. be the lost production of some consumer goods.

C. be slower economic growth in the future.

D. not involve any sacrifice of either capital or consumer goods.

Refer to Goods X and Y. Suppose the consumer is at an optimum, spending all his income on good X. How are the marginal value of X and the relative price of X related at this corner solution?

Assume that good X is on the horizontal axis and good Y is on the vertical axis in the consumer-choice diagram. PX denotes the price of good X, PY is the price of good Y, and I is the consumer's income. Unless otherwise stated, the consumer's preferences are assumed to satisfy the standard assumptions. a. The marginal value of X and the relative price of X must be equal. b. The marginal value of X must be less than or equal to the relative price of X. c. The marginal value of X must be greater than or equal to the relative price of X. d. There is no definite relationship between the marginal value and the relative price of X.

The GDP deflator in year 2 is 105, using year 1 as the base year. This means that, on average, the cost of goods and services is

A) 5% higher in year 2 than in year 1. B) 105% higher in year 1 than in year 2. C) 105% higher in year 2 than in year 1. D) 5% higher in year 1 than in year 2.

If Texans decrease their purchases of Mexican beer, assuming all else remains constant, this will ________ of the United States

A) decrease the financial account balance B) decrease net exports C) increase the trade deficit D) decrease the current account balance