Exhibit 11-4 Taxable Income Taxes $0 - $23,000 15% of taxable income $23,001 - $42,000 $3,450 + 20% of everything over $23,000 $42,001 - $100,000 $7,250 + 25% of everything over $42,000 Greater than $100,000 $21,750 + 30% of everything over $100,000 Refer to Exhibit 11-4. If a person's taxable income is $20,000, how much does he pay in taxes?

A) $600

B) $30,000

C) $18,000

D) $3,000

D

You might also like to view...

When the absolute price elasticity of demand equals 1, demand is

A) elastic. B) unit-elastic. C) inelastic. D) undetermined without more information.

The expression "There's no such thing as a free lunch" means

What will be an ideal response?

Measuring the impact of the protection on the U.S. economy and on Harley-Davidson:

a. is very clear—it was a success. b. is very clear—it was a failure. c. is not as black and white as the numbers might show, but saving a profitable company at a low cost has some merit for the U.S. economy. d. should take into consideration that Harley-Davidson was a private firm with private stockholders. Most economists disagree with government efforts to save it from bankruptcy.

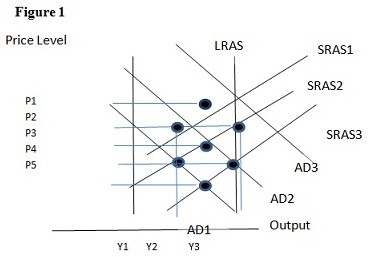

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.