The buyer will pay the entire tax levied on a good when the demand for the good is ________ or when the supply of the good is ________

A) perfectly elastic; perfectly inelastic

B) perfectly elastic; perfectly elastic

C) perfectly inelastic; perfectly inelastic

D) perfectly inelastic; perfectly elastic

E) unit elastic; unit elastic

D

You might also like to view...

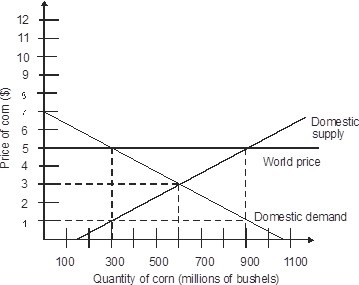

In an open economy, the quantity supplied of bushels of corn is ________.

A. 300 million bushels B. 600 million bushels C. 900 million bushels D. 150 million bushels

The labor-force participation rate shows the percentage of

A) non-institutionalized working-age people who are actually working or seeking employment. B) people not working, but who want to work. C) new entrants into the labor force. D) people who are not actively participating in meaningful economic activity.

The economist known for his early empirical work supporting the efficient markets hypothesis is

A) Milton Friedman. B) John Muth. C) Eugene Fama. D) Glenn Hubbard.

The marginal tax rate is the tax rate paid on

A. all supplemental income. B. any additional income earned. C. all income earned. D. taxable retirement income.