The marginal income tax rate is:

A. always less than the average tax rate.

B. the tax rate applied to an additional dollar of income.

C. always equal to the average tax rate.

D. the tax rate applied to all income.

Answer: B

You might also like to view...

The price elasticity of demand is measured as the percentage change in quantity demanded divided by the percentage change in price

Indicate whether the statement is true or false

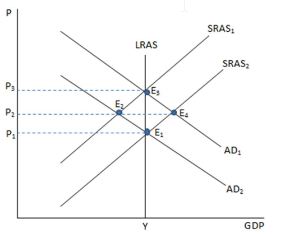

If the economy is in a recession, which point in the graph shown would likely represent this?

A. E1

B. E2

C. E3

D. E4

If M = the quantity of money, m the money multiplier, MB the Monetary Base, C = Currency, D = Deposits, R = Reserves, RR = required reserves, and ER = Excess reserves, then RR would equal:

A. MB. B. M/MB. C. D - C. D. R - ER.

Which of the following would be an example of case-based payment?

A. Four-tier pharmacy formularies B. Copayment waivers for primary care services C. Medicare DRGs D. All of the above