Define tax incidence

What will be an ideal response?

Tax incidence is the ultimate distribution of a tax's burden. In other words, it indicates who actually bears the cost of paying the tax.

You might also like to view...

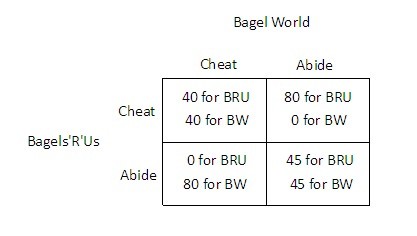

The market for bagels contains two firms: BagelWorld (BW) and Bagels'R'Us (BRU). The owners of the two firms decide to fix the price of bagels. The table below shows how each firm's profit (in dollars) depends on whether they abide by the agreement or cheat on the agreement.  For Bagel World, ________ is a ________.

For Bagel World, ________ is a ________.

A. abiding by the agreement; dominant strategy when Bagels'R'Us also abides B. abiding by the agreement; dominant strategy C. cheating on the agreement; dominant strategy D. cheating on the agreement; dominated strategy

The simplest economic definition of discrimination is

A. prejudice. B. unequal pay for equal work. C. a dislike by one group associating with another group. D. unequal pay for unequal work.

In a multi-bank system, the amount of money that the system can create is found by using the money ____________.

a. magnifier b. creator c. multiplier d. compounder

Rapid growth of government spending in Latin America in the 1970s led to

A) the Debt Crisis. B) rapid economic growth. C) direct foreign investment. D) capital outflows.