An appreciation of the U.S. dollar would

a. encourage foreigners to invest in the United States.

b. discourage foreigners from buying U.S. goods.

c. discourage the travel abroad of U.S. citizens.

d. encourage foreign travel in the United States.

b. discourage foreigners from buying U.S. goods.

You might also like to view...

The U.S. economy of the late 1920s and early 1930s is typically referred to as ________

A) "The Great Depression" B) "The Great Inflation" C) "The Great Moderation" D) all of the above E) none of the above

Ricardian equivalence will fail to hold if:

A. people increase their spending when they receive a tax rebate check. B. people save, and do not increase their spending when they receive a tax rebate check. C. intended expansionary effects of tax policy fail to occur. D. All of these.

If the reserve ratio is 15 percent, and banks do not hold excess reserves, and people hold only deposits and no currency, then when the Fed sells $25.5 million worth of bonds to the public, bank reserves

a. increase by $25.5 million and the money supply eventually increases by $382.5 million. b. increase by $25.5 million and the money supply eventually increases by $170 million. c. decrease by $25.5 million and the money supply eventually decreases by $382.5 million. d. decrease by $25.5 million and the money supply eventually decreases by $170 million.

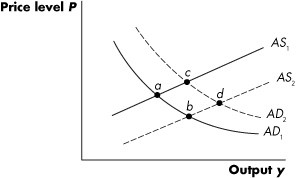

Refer to Figure 14.2. A movement from point a to point b could be caused by a(n):

Refer to Figure 14.2. A movement from point a to point b could be caused by a(n):

A. increase in government spending. B. decrease in the price of oil. C. decrease in taxes. D. decrease in short-run aggregate supply.