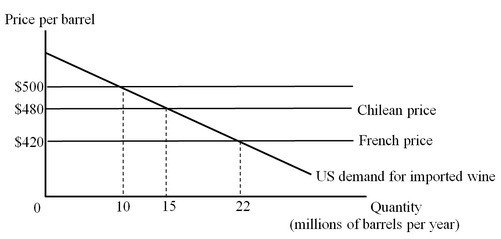

The figure below shows the U.S. market for imported wine. For simplicity, we consider export supply curves to be flat. Chilean wine is available for $480 per barrel and French wine is available for $420 per barrel. Suppose the United States has a tariff of $80 per barrel on imported wine. Then, the United States joins a free-trade area with Chile. What will be the change in the net national surplus after the United States enters into a free-trade agreement with Chile?

Suppose the United States has a tariff of $80 per barrel on imported wine. Then, the United States joins a free-trade area with Chile. What will be the change in the net national surplus after the United States enters into a free-trade agreement with Chile?

A. -$970 million

B. -$50 million

C. +$50 million

D. +$250 million

Answer: D

You might also like to view...

The conduct of monetary policy is the responsibility of:

a. commercial banks. b. the U.S. Treasury. c. the Federal Reserve System. d. the Congress and the president.

Oligopoly firms: a. usually act as if they were a monopoly producer

b. generally charge a price for goods and services equal to marginal cost. c. base their pricing and output decisions on the likely responses of rival firms. d. are isolated from competition by low barriers to entry.

How does the price system cope with depletable resources?

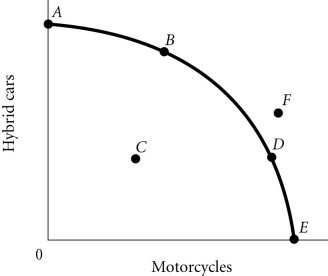

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

A. increases B. remains constant. C. initially increases, then decreases. D. decreases.