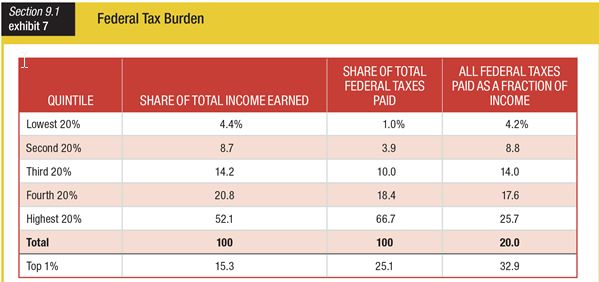

Based on the table for the federal tax burden, the highest 20% earns about half of all income, but pays about ______ of income taxes.

a. 1/10

b. 1/4

c. 2/3

d. 3/4

c. 2/3

You might also like to view...

When comparing the standard of living in two countries it is important to adjust total output for differences in:

A. population B. geographic area C. political systems D. employment levels

What is meant by holding all else equal? How is this concept used when discussing movements along the demand curve? How is this concept used when discussing movements along the supply curve?

What will be an ideal response?

All of the following are true about a monopolist except:

A. Average and marginal revenues are not the same. B. Marginal revenue is greater than price. C. Marginal revenue can be negative. D. Marginal revenue decreases with increases in output.

Most of the public debt is owed to citizens and domestic institutions. This is one reason that the public debt:

A. has a procyclical economic effect on the economy. B. can result in the bankruptcy of the federal government. C. crowds out private investment. D. does not impose a burden on future generations.