The long-run effect of reducing the government budget deficit would be

a. a higher price level and a lower level of output

b. a lower price level and a lower level of output

c. a higher price level and a higher level of output

d. a higher price level with unchanged output

e. a lower price level with unchanged output

E

You might also like to view...

If there is no Ricardo-Barro effect, an increase in the government budget surplus

A) increases the supply of loanable funds. B) decreases private saving. C) increases private saving. D) decreases the supply of loanable funds. E) has no effect on the demand for loanable funds, the supply of loanable funds, or the real interest rate.

A sales tax imposed on sellers shifts the supply curve leftward for the taxed good because the

A) tax is paid by the seller to the government and is, therefore, like a cost of production. B) tax is actually shifted entirely onto the buyer who can afford only a smaller supply. C) higher price causes entry into the market. D) tax shifts the demand curve leftward.

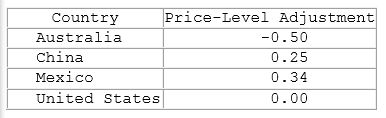

According to the information in the table shown, if someone were earning $20,000 in Mexico, approximately what would he need to earn in the United States to enjoy the same amount of goods and services?

This table shows the price-level adjustment as compared to the United States.

A. $30,303

B. $35,000

C. $20,030

D. $15,000

Given the following formula for the Taylor rule:Target federal funds rate = natural rate of interest + current inflation + 1/2(inflation gap) +1/2(output gap) If output in the economy were to fall by an additional one percent below potential, the target federal funds rate would:

A. Increase by 1.5%. B. Remain at 2.5%. C. Decrease by 0.5%. D. Decrease by 1.5%.