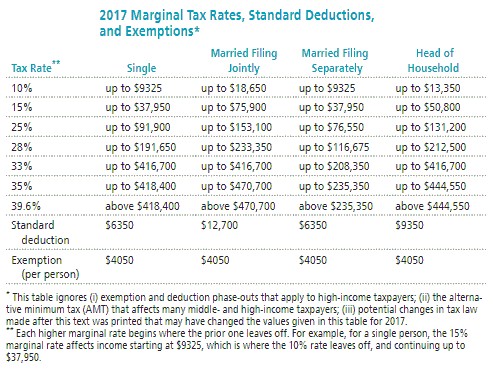

Solve the problem. Refer to the table if necessary. Matt is single and earned wages of $32,315. He received $445 in interest from a savings account. He contributed $485 to a tax-deferred retirement plan. He had $595 in itemized deductions from charitable contributions. Calculate his taxable income.

Matt is single and earned wages of $32,315. He received $445 in interest from a savings account. He contributed $485 to a tax-deferred retirement plan. He had $595 in itemized deductions from charitable contributions. Calculate his taxable income.

A. $25,330

B. $37,295

C. $27,630

D. $21,875

Answer: D

You might also like to view...

Complete the identity.tan ?(cot ? - cos ?) = ?

A. 1 B. -sec2 ? C. 0 D. 1 - sin ?

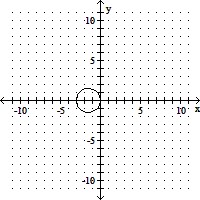

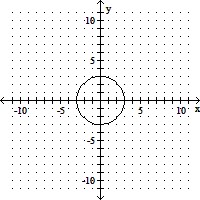

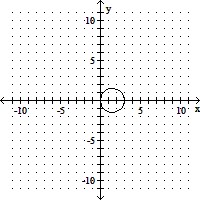

Graph the circle.x2 + y2 = 9

A.

B.

C.

D.

Who was one of the first American psychologists to advocate a behavioral approach to understanding human development?

A. B. F. Skinner B. John B. Watson C. Jean Piaget D. S. C. Johnson

Which research strategy focuses on the relationship between behavior and underlying physiological processes?

A. psychophysiological B. ethnography C. experimental D. case study