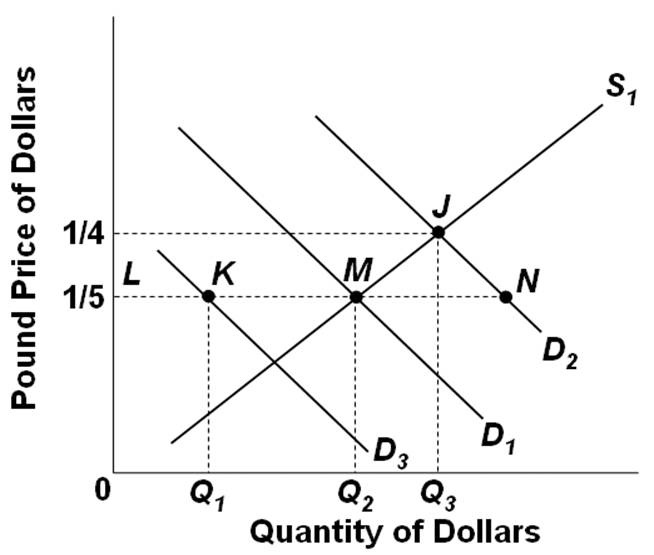

Refer to the graph below. Assume that D1 and S1 are the initial demand for and supply of dollars. Now suppose that Great Britain increases its imports of American products. Assuming freely floating exchange rates:

The graph below shows the supply and demand curves for dollars in the pound/dollar market.

A. The pound price of dollars will fall to 1/5 pound equals $1

B. The pound price of dollars will rise to 1/4 pound equals $1

C. The dollar price of pounds will increase to $5 equals 1 pound

D. A dollar shortage of MN will result in Britain

B. The pound price of dollars will rise to 1/4 pound equals $1

You might also like to view...

Suppose that in the market for paper, demand is p = 100 - Q. The private marginal cost is MCp = 10 + Q. Pollution generated during the production process creates external marginal harm equal to MCe = Q

What specific tax would result in a competitive market producing the socially optimal quantity of paper?

When oligopolistic companies engage in collusion, the companies are involved in a

A) noncooperative game. B) negative-sum game. C) competitive game. D) cooperative game.

Which of the following is not an example of a demand shock?

a. A reduction in government spending b. An increase in income tax rates c. A change in oil prices. d. A money supply increase. e. An increase in government spending.

All of the following are automatic fiscal stabilizers EXCEPT

A. a congressionally mandated decrease in tax rates to stimulate the economy. B. an increase in unemployment expenditures during a recession. C. a decrease in overall tax revenues during a recession. D. a decrease in unemployment compensation payments during an expansion.