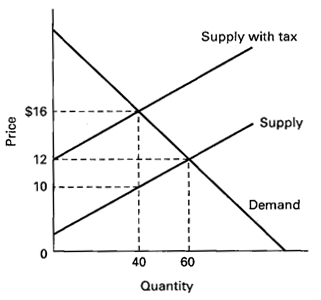

In the graph below, if the government imposes an excise tax as shown, what is the tax burden to the seller? And to the buyer? Explain

What will be an ideal response?

The tax per unit is $6. The seller pays $2 per unit ($12 ? $10) and the buyer pays $4 per unit ($16 ? $12). The tax burden for the seller is $80 ($2 ? 40 units). The tax burden for the buyer is $160 ($4 ? 40 units).

You might also like to view...

If the percentage change in the quantity supplied of a good is less than the percentage change in price of the good, the good is said to have a(n):

A) inelastic supply. B) unit elastic supply. C) elastic supply. D) perfectly elastic supply.

Refer to Table 4.2. If you choose to invest in Japanese bonds, your investment return from Scenario C will be

A) -3%. B) -1%. C) 2%. D) 5%.

The velocity of circulation is the

a. speed at which the multiplier takes effect. b. speed at which money circulates. c. speed at which tax cuts get spent. d. rate at which money creation takes place.

In effect, tariffs on imports are:

A. special taxes on domestic producers. B. subsidies to domestic consumers. C. subsidies to foreign producers. D. subsidies for domestic producers.