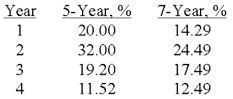

On July 1, Year 1, Glover Corporation purchased $80,000 of equipment. The equipment is expected to be used in the business for five years and has an estimated salvage value of $11,000. Partial MACRS tables are listed below: Required: a) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 5-year property.b) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 7-year property.

Required: a) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 5-year property.b) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 7-year property.

What will be an ideal response?

a) (1) $16,000

a) (2) $25,600

b) (1) $11,432

b) (2) $19,592

a) Five-Year Property:

(1) Year 1: Cost of 80,000 20% = $16,000

(2) Year 2: Cost of $80,000 32% = $25,600

b) Seven-Year Property:

(1) Year 1: Cost of $80,000 14.29% = $11,432

(2) Year 2: Cost of $80,000 24.49% = $19,592

You might also like to view...

The purchases discounts account is credited for cash discounts allowed by vendors

Indicate whether the statement is true or false

Explain the DADA Syndrome.

What will be an ideal response?

An employer has an employee benefit package that includes employer-paid health insurance and an employer-paid retirement program. The March payroll included contributions of $5,500 for health insurance, and 10% of the employees' $120,000 gross salaries for the employee retirement program. Prepare the journal entry to record these employee benefits.

What will be an ideal response?

Which of the following would be least likely to be an invasion of privacy:

a. the use of a person's photograph without permission b. pleading with a movie star for an autograph c. publication of information about a person that comes from private sources d. publication of information about a person that places them in a false light to others e. walking into the home of a famous sports personality without permission