Bunsen Company is involved in a consumer liability lawsuit. Company attorneys have assessed the contingent outcomes of the lawsuit. Because the attorneys think the company will probably lose the lawsuit, To prepare for this loss, Bunsen management has decided to set aside funds in an investment account that earns a 9% return rate. Furthermore, there is general agreement that there is a 60%

probability the company will have to pay the defendants $6 million four years from now; a 30% probability the company will need to pay $10 million eight years from now, and a 10% probability the company will pay nothing. What amount should Bunsen accrue as a contingent liability?

A) ?$4,055,928

B) ?$6,179,473

C) ?$6,600,000

D) ?$9,269,210

A

You might also like to view...

Identify and briefly explain the four steps a company should take to practice CRM and develop one-to-one relationships with its customers

What will be an ideal response?

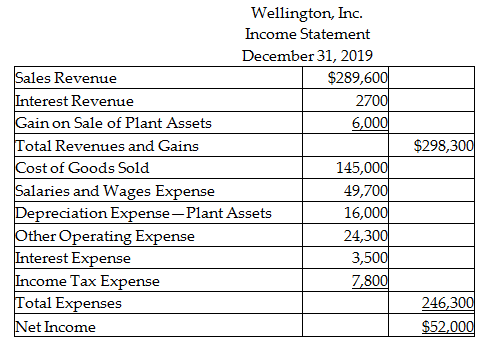

Use the direct method to compute the total cash receipts from operating activities.

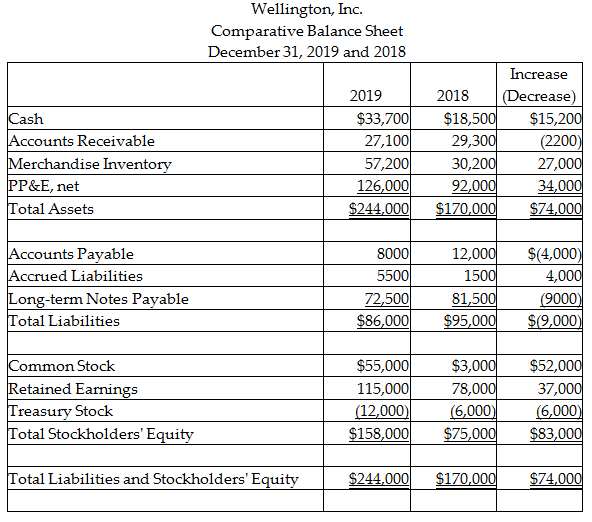

Wellington, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2019:

A) $287,400

B) $294,500

C) $260,300

D) $296,100

Which of the following statements is not true under the Fair Labor Standards Act?

A) Children ages 16 and 17 may work unlimited hours in nonhazardous jobs. B) Persons age 18 or over may work unlimited hours in nonhazardous jobs. C) Children ages 14 and 15 may work limited hours in nonhazardous jobs. D) Children under 14 cannot work at all, except on farms. E) Persons age 18 or over may work unlimited hours in hazardous jobs.

For each item listed below, indicate whether it involves a:

a.permanent difference.b.temporary difference that will result in future deductible amounts (giving rise to deferred tax assets).c.temporary difference that will result in future taxable amounts (giving rise to deferred tax liabilities).? ____1. Rent is collected in advance from a tenant. Rent is taxable when received. ____2. Warranty costs are accrued at the time of sale for accounting purposes, but are not deductible until paid for income tax purposes. ____3. Interest revenue is recorded on municipal bonds. ____4. Installment sales are recognized at the point of sale for accounting purposes, but when the cash is received for income tax purposes. ____5. A loss contingency is expensed for accounting purposes. The company expects to pay the amount involved in three years. ____6. Bad debt expense is estimated for accounting purposes, but is not deducted for income tax purposes until written off. ____7. The company paid a fine from the EPA for violation of environmental regulations.? Required:Match each item to its descriptive phrase by placing the appropriate letter in the space provided. What will be an ideal response?