The basic purpose of imposing legal reserve requirements on commercial banks is to:

A. Assure the liquidity of commercial banks

B. Provide a device through which the credit-creating activities of banks can be controlled

C. Provide a proper ratio between earning and no earning bank assets

D. Provide the central banks with necessary working capital

B. Provide a device through which the credit-creating activities of banks can be controlled

You might also like to view...

Which of the following changes is most likely to happen when there is a decrease in the supply of money in a market that was initially in equilibrium?

a. The demand for money increases b. Planned investment spending increases c. Interest rate increases d. Aggregate expenditure increases e. The demand for money decreases

The presence of involuntary part-time workers

a. causes the official unemployment rate to underestimate actual unemployment b. causes the official unemployment rate to overestimate actual unemployment c. has no effect on the accuracy of the official unemployment rate d. is accounted for in the official unemployment rate e. is insignificant in the U.S. economy and thus is no cause for concern

When a government intentionally lowers the value of its currency, that is called depreciation

a. True b. False Indicate whether the statement is true or false

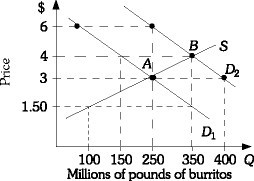

Refer to the information provided in Figure 3.18 below to answer the question(s) that follow. Figure 3.18Refer to Figure 3.18 The market is initially in equilibrium at Point B. If demand shifts from D2 to D1 and the price of burritos remains constant at $4.00, there will be

Figure 3.18Refer to Figure 3.18 The market is initially in equilibrium at Point B. If demand shifts from D2 to D1 and the price of burritos remains constant at $4.00, there will be

A. an excess supply of 100 million pounds of burritos. B. an excess demand of 200 million pounds of burritos. C. an excess supply of 200 million pounds of burritos. D. an excess demand of 100 million pounds of burritos.