In the late 1990s, the more than expected increases in tax revenues were the result of

A. rapid economic growth.

B. rapid increases in the national debt.

C. rising rates of inflation, and therefore, nominal incomes.

D. rising balance of trade surpluses and the import duties they generated.

Answer: A

You might also like to view...

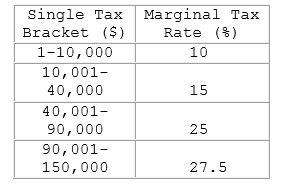

For a person earning $15,000, the average tax rate is:

A. 10%

B. 15%

C. 12.5%

D. 11.7%

The goal of expansionary fiscal policy with respect to output is to:

A. increase spending and aggregate demand to get back to an output level the government is comfortable with. B. decrease government spending in an attempt to get the private economy back on track. C. increase spending and shift aggregate demand to the left in an effort to reach full employment output. D. increase spending and shift aggregate demand to the right in an effort to reach full employment output.

To determine the equilibrium price level and equilibrium level of real GDP, the aggregate demand and aggregate supply must:

A. be considered separately. B. intersect. C. be disregarded. D. be considered as a multiplier.

The movement away from bank lending towards asset-backed securities has:

A. increased the importance of the bank-lending channel of monetary policy. B. led the FOMC to abandon interest-rate targets. C. decreased the importance of the bank-lending channel. D. eliminated the bank-lending channel as a mechanism for monetary policy.