On December 31 . 2013 . Freulein Company had 8,000 shares of common stock issued and outstanding. On April 1 . 2014, an additional 1,500 shares of common stock were issued and on July 1 . 500 more shares were issued. On October 1 . 2014, Freulein issued 10, $1,000 maturity value, 8% convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common

stock in 2014 . Assuming there are no antidilutive securities, what is the number of shares Freulein should use to compute diluted earnings per share for the year ended December 31 . 2014?

a. 9,325

b. 9,475

c. 9,525

d. 9,775

B

You might also like to view...

It can be difficult to determine which expenses will change when a department is discontinued

Indicate whether the statement is true or false

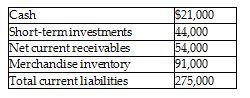

What is the acid-test ratio for a merchant with the following account balances? (Round your answer to two decimal places.)

A) 0.76

B) 0.43

C) 0.60

D) 0.83

On January 2, 20x5, Preston Corporation issued 20-year bonds payable with a face value of $300,000 and a face interest rate of 8 percent. The bonds were issued to yield a market interest rate of 9 percent. Interest is payable semi-annually on January 1 and July 1. In calculating the present value of the bond issue of January 2, 20x5, the periodic interest payments to be used are

A) $24,000. B) $12,000. C) $27,000. D) $13,500.

How can the six Cs of communication be used to write messages that are tailored to the reader's needs?

What will be an ideal response?