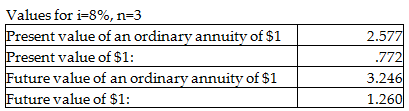

Jenna would like to purchase a new car in three years. If she saves $1,000 per year in an account that pays 8% annual interest for the next 3 years, how much will she have saved for a down payment? (Round the final answer to the nearest dollar.)

A) $3,246

B) $3,772

C) $3,577

D) $2,577

A) $3,246

Explanation: $1,000 × 3.246 (future value of an ordinary annuity of $1) = $3,246

You might also like to view...

Why are demand and promotional merchandise placed in the back left-hand corner of the store?

What will be an ideal response?

Lester Company purchases a piece of equipment on Jan. 2, 2010, for $30,000 . The equipment has an estimated life of eight years or 50,000 units of production and an estimated residual value of $3,000 . Lester uses a calendar fiscal year. The entry to record the amount of depreciation for 2010, using the straight-line method, is:

a. Depreciation Expense– Equipment 3,750 Cash 3,750 b. Depreciation Expense — Equipment 3,375 Accumulated Depreciation– Equipment 3,375 c. Depreciation Expense — Equipment 2,500 Accumulated Depreciation– Equipment 2,500 d. Accumulated Depreciation - Equipment 2,250 Cash 2,250

Galveston Excursons Corporation is considering the purchase of a new ocean-going vessel that could potentially reduce labor costs of its operation by a considerable margin. The new ship would cost $600,000 and would be fully depreciated by the straight-line method over 15 years. At the end of 15 years, the ship will have no value and will be scuttled. Galveston Excursons' cost of capital is 14

percent, and its marginal tax rate is 35 percent. Refer to Galveston Excursons Corporation. What is the present value of the depreciation tax benefit of the new ship? (Round to the nearest dollar.) Present value tables or a financial calculator are required. a. $ 85,991 b. $159,697 c. $210,000 d. $245,688

Mrs. Baird's is attempting to forecast sales for a new ice cream cake. To come up with an accurate forecast, Mrs. Baird's places the product in Atlanta supermarkets for a period of four months. In this instance, Mrs. Baird's is using which forecasting method?

A. Time series analysis B. Market test C. Executive judgment D. Regression analysis E. Survey