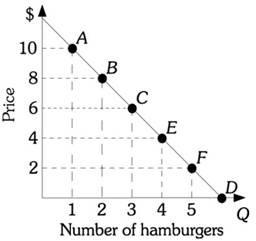

Refer to the information provided in Figure 5.2 below to answer the question(s) that follow. ?Figure 5.2Refer to Figure 5.2. If the price of a hamburger decreases from $10 to $6, the price elasticity of demand equals ________. Use the midpoint formula.

?Figure 5.2Refer to Figure 5.2. If the price of a hamburger decreases from $10 to $6, the price elasticity of demand equals ________. Use the midpoint formula.

A. -0.5

B. -2.0

C. -20

D. -200

Answer: B

You might also like to view...

If the price elasticity of demand for U.S. automobiles is higher in Europe than it is in the United States, and transport costs are zero, a price-discriminating monopolist would charge

A) the same price for autos in the United States as in Europe. B) a lower price for autos in the United States than in Europe. C) a higher price for autos in the United States than in Europe. D) a less profitable price for autos in the United States than in Europe.

When a firm incurs negative economic profit, it should:

a. hire more laborers to make the business activity profitable. b. transfer the resources from its current use to other alternative uses. c. purchase additional raw materials to produce more output. d. transfer additional resources from other alternative uses to the current activity. e. continue to operate with the same resources.

The monopoly’s ability to restrict output results in lower profits than other types of firms.

Answer the following statement true (T) or false (F)

Assume that the central bank increases the reserve requirement. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the GDP Price Index and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The GDP Price Index falls, and reserve-related (central bank) transactions become more negative (or less positive). b. The GDP Price Index falls, and reserve-related (central bank)transactions remain the same. c. The GDP Price Index and reserve-related (central bank) transactions remain the same. d. The GDP Price Index rises, and reserve-related (central bank) transactions remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.