If total deposits at Resolute Bank and Trust are $100 million, total loans are $70 million, and excess reserves are $20 million, then which of the following is the required reserve ratio?

a. 10 percent

b. 20 percent

c. 30 percent

d. 70 percent

a

You might also like to view...

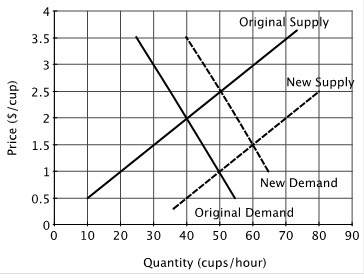

Refer to the figure below. Consider the original supply and the original demand curve. If the government imposes a price ceiling of $1.00 on a cup of coffee, then there would be:

A. a new equilibrium at a price of $1.00 per cup and a quantity of 50 cups per hour. B. a short-term excess demand for coffee, followed by an increase in the equilibrium price. C. an excess supply of coffee. D. an excess demand for coffee.

When the expenditure schedule is too low, the result is a(n)

A. unemployment surplus. B. inflationary gap. C. recessionary gap. D. budgetary gap.

The interest rate is the price borrowers pay to borrow money.Key interest rates are controlled by the Federal Reserve System.If the Federal Reserve acts to reduce interest rates, economists would expect the quantity of money demanded to

A. increase. B. decrease. C. not change. D. not change, although the demand schedule itself will shift outward.

According to the figure above, which of the following events will increase the quantity demanded of bottled water?

A) a fall in the price of soda B) a rise in the price of a fitness club membership C) an increase in the number of buyers of bottled water D) a fall in the price of bottled water E) a rise in the price of bottled water