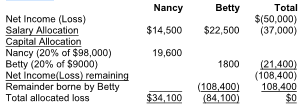

The partnership's net loss for the first year is $50,000. Nancy's capital balance is $98,000 and Betty's capital balance is $9000 at the end of the year. Calculate the share of profit (loss) to be allocated to Nancy.

Nancy and Betty enter into a partnership agreement whereby they undertake to share profits

according to the following rules:

(a) Nancy and Betty will receive salaries of $14,500 and $22,500 respectively as the first allocation.

(b) The next allocation is based on 20% of each partner's capital balances.

(c) Any remaining profit or loss is to be allocated completely to Betty.

A) $34,100

B) $(19,600)

C) $14,500

D) $(84,100)

A) $34,100

Explanation: The allocation of profit or loss can also be based on a combination of services, capital

balances, and stated ratios. A partnership might want to use this method if one partner contributes more

capital but the other partner devotes more time to the business.

Calculation

You might also like to view...

Kareem writes a check for $1,000 drawn on Liberty Bank and presents it to Maris. Maris presents the check for payment to Liberty Bank, which dishonors it. The party most likely liable to Maris is

A. Kareem in a civil suit. B. Kareem in a criminal prosecution. C. Liberty Bank in an administrative proceeding. D. the Federal Reserve.

Which of the following is a right of a limited partner in a limited partnership:

a. the right to see the partnership books b. the right to participate in the dissolution of the business c. the right to take an active role in managing the business d. both a and b are rights of a limited partner e. none of the other specific choices are rights of a limited partner

In Bearden v. Wardley Corp, where Bearden sued Wardley because one of its agents, Gritton, bought a house from her and then cheated her on the transaction, the court held that:

a. Gritton was liable for breaching his duty to Bearden, but Wardley had no knowledge of Gritton's actions so was not liable b. Gritton was liable for theft, but not for breach of his duty as an agent to Bearden, since that relationship expired before Gritton cheated Bearden c. Gritton and Wardley violated their fiduciary obligations to Bearden, so both are liable d. neither party was liable to Bearden because the contract was legitimate and her claim that she had been cheated by her agent, Gritton, was unfounded e. none of the other choices

The population being studied is usually considered ______ if it involves an ongoing process that makes listing or counting every element in the population impossible

a. finite b. infinite c. skewed d. symmetric