Assume that the Federal Reserve replaces the money stock with the interest rate as an intermediate target. Then,

a. the range for the target interest rate would be chosen to hit the inflation rate, unemployment rate, and growth rate of the economy.

b. if the Treasury bill rate fell temporarily below the target range, the Open Market Desk would sell securities in the open market until the Treasury bill rate rose to the target range.

c. if the Treasury bill rate rose above the target range, the Open Market Desk would purchase Treasury bills or other government securities.

d. All of the above

D

You might also like to view...

In a monopolistically competitive market, a successful new restaurant

A) can earn economic profits in the long run if it uses barriers to restrict entry by new restaurants. B) must obtain a trademark to ensure that it will break even in the long run. C) will face high entry barriers because of health and safety regulations to which all restaurants are subject. D) will earn zero economic profit in the long run because of free entry, but competition will lead restaurants to offer different versions of the same product.

Given the following formula for the Taylor rule:Target federal funds rate = natural rate of interest + current inflation + 1/2(inflation gap) +1/2(output gap) if the current rate of inflation is 5%, the natural rate of interest is 2%, and the target rate of inflation is 2%, and output is 3% above its potential, the target federal funds rate would be:

A. 6.5%. B. 10%. C. 2.5%. D. 3.5%.

The equilibrium price in a market is found where

A. The market demand curve intersects the y-axis. B. The market supply curve intersects the market demand curve. C. The market supply curve intersects the y-axis. D. The market supply curve intersects the x-axis.

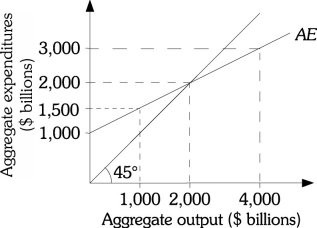

Refer to the information provided in Figure 24.1 below to answer the question(s) that follow. Figure 24.1Refer to Figure 24.1. At equilibrium, injections

Figure 24.1Refer to Figure 24.1. At equilibrium, injections

A. can be greater than $1,000 billion. B. equal $1,500 billion. C. equal $2,000 billion. D. equal leakages.