Margin calls are more likely to happen when markets are:

A. crashing.

B. booming.

C. stable.

D. irrational.

A. crashing.

You might also like to view...

A decline in the price of a bond causes the yield of the bond to

A) rise. B) fall. C) remain unchanged. D) rise if it's a short-term bond, fall if it's a long-term bond.

What is the misery index? What are the economic conditions when it is low versus when it is high?

What will be an ideal response?

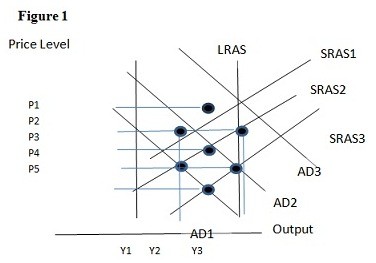

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

Recall the Application about how policymakers use stress tests to protect the financial system to answer the following question(s).According to this Application, if a bank does NOT pass the test, the Fed can:

A. prevent the bank from paying out dividends to its shareholders. B. make the bank raise additional capital from the financial markets. C. force the bank to close. D. Both prevent the bank from paying out dividends to its shareholders and make the bank raise additional capital from the financial markets are correct.