In the MPR context, CGM is the abbreviation for ________

A) consumer goods market.

B) cost of goods manufactured.

C) consumer generated marketing.

D) communication generated messages.

E) corporation general meeting

C

You might also like to view...

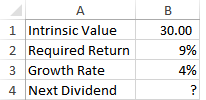

Polaris Inc. stock is selling for $30 a share based on a 9% rate of return. What is the correct formula in B4 to calculate the next annual dividend payment if the dividends are expected to grow at 4% annually?

a) =B2*(B1-B3)

b) =B1/(B2-B3)

c) =B1*(B2+B3)

d) =B1*(B2-B3)

e) =B3*(B2-B1)

If bonds are issued at a premium, the face interest rate is

a. lower than the market rate of interest. b. higher than the market rate of interest. c. too low to attract investors. d. adjusted to a higher effective rate of interest.

In which of the following cases will an oral contract for the sale of goods of $750 be enforceable without a writing?

a. The goods are to be specially manufactured for the buyer and the seller has made a substantial beginning of their manufacture. b. A party admits in an answer to a complaint in a lawsuit that the contract was made. c. Delivery and acceptance of the goods has been made. d. All of the above.

A firm is evaluating a new machine to replace one of its existing, older machines. If the old machine is replaced, the change in the annual depreciation expense will be $3,000. The firm's marginal tax rate is 30 percent. Which of the following statements is correct?

A. The depreciation expense does not affect the calculation of the supplemental operating cash flows, so it should not be considered in the analysis of the machine. B. The depreciation expense can be added to the machine's after-tax net operating income to determine its supplemental operating cash flows. C. The depreciation expense should be added to the machine's initial investment outlay. D. The depreciation expense is included in the computation of the machine's terminal cash flows. E. The depreciation expense should be included in the analysis only if it exceeds the tax expense associated with the machine.