Explain why there were so many bank failures in the 1980s and 1990s

These bank failures reflected the shocks in agriculture and the oil industry. High agricultural prices in the

1970s led farmers to borrow heavily to invest in land and machinery. Falling farm prices in the 1980s

caused land values to fall, and many farmers went bankrupt and defaulted on their bank loans. Also, in the

1970s, many banks made loans to oil-exporting countries such as Mexico. When oil prices fell dramatically

in the 1980s, many borrowers defaulted, leading banks to fail. As well, deregulation of the banking industry

led to greater competition between S&Ls, banks, and investment houses, and to less government control

over S&L behavior. The new competition made it necessary for S&Ls to pay higher interest rates to keep

their depositors. They began to make riskier loans in order to recoup the losses from the higher interest

payments. Less government oversight led to a substantial increase in S&L fraud, in the form of bad loans to

S&L managers and to their friends and families. The existence of FSLIC (the government-created program

to provide insurance to depositors) contributed to the demise of many S&Ls, because, with the guarantee that depositors would not suffer from mistakes, S&Ls had less incentive to prevent failure from occurring.

You might also like to view...

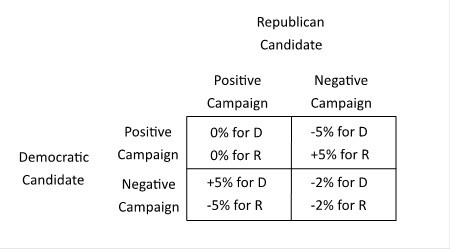

The table below shows how the payoffs to two political candidates depend on whether the candidates run a positive or negative campaign. The payoffs are given in terms of the percentage change in the number of votes received.  Suppose that the Republican candidate tells the Democratic candidate that he intends to run a positive campaign. The likely result is that:

Suppose that the Republican candidate tells the Democratic candidate that he intends to run a positive campaign. The likely result is that:

A. the Republican candidate will run a positive campaign, and the Democratic candidate will run a negative campaign. B. both candidates will run a negative campaign. C. the Republican candidate will run a negative campaign, and the Democratic candidate will run a positive campaign. D. both candidates will run a positive campaign.

The statement “Resources employed in producing X are better suited to making Y” is another way of saying

A. the production possibilities frontier is “bowed out.” B. the production possibilities frontier is a straight line. C. the production possibilities frontier is “bowed in.” D. resources are unproductive. E. resources have no opportunity cost.

The behavior of regulators when trying to win approval for their actions from their entire constituency is best described by the

A) capture hypothesis. B) law of increasing social well-being. C) share-the-gains, share-the-pains hypothesis. D) marginal benefit pricing hypothesis.

In the arena of decision making, status-quo bias means that the "‘default'" option:

A. has a lot of power. B. is most likely to be chosen. C. is the one that will automatically take place if the chooser fails to make an active decision. D. All of these statements are true.