Which of the following statements regarding Individual Retirement Accounts (IRA) is incorrect?

A. Excess contributions to an IRA are subject to an excise tax.

B. Contributions to a conventional IRA may be tax-deductible while contributions to a Roth IRA are never tax-deductible.

C. Once a taxpayer reaches age 70½, deductible contributions cannot be made to a conventional IRA.

D. Because IRA contributions are based on compensation, a non-working spouse cannot make a contribution to an IRA.

Answer: D

You might also like to view...

Which of the following is used in the cash payments journal to indicate posting to the subsidiary ledger?

a. a check mark; b. an account number; c. a page number; d. CPJ; e. J2

The significant characteristic of transformational leadership is that it ______.

A. gives a leader absolute power B. reduces the responsibility of the leader C. balances power between the leader and subordinates D. offers an approach to leading both subordinates and organizations

Do not generally use commas before ______________

a. a quote b. a title c. and d. therefore

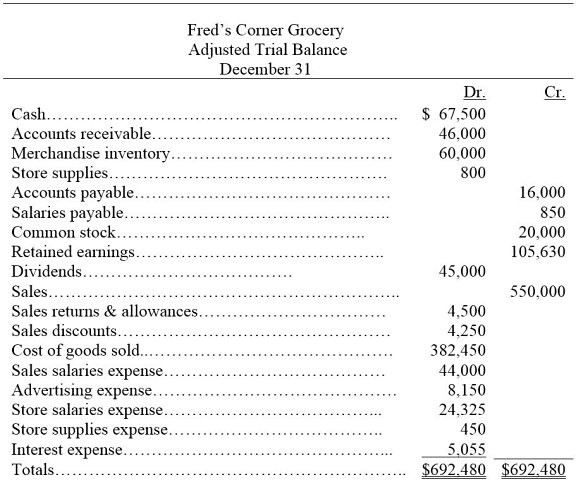

Following is the year-end adjusted trial balance for Fred's Corner Grocery for the current year: Prepare the closing entries at December 31 for the current year.

Prepare the closing entries at December 31 for the current year.

What will be an ideal response?