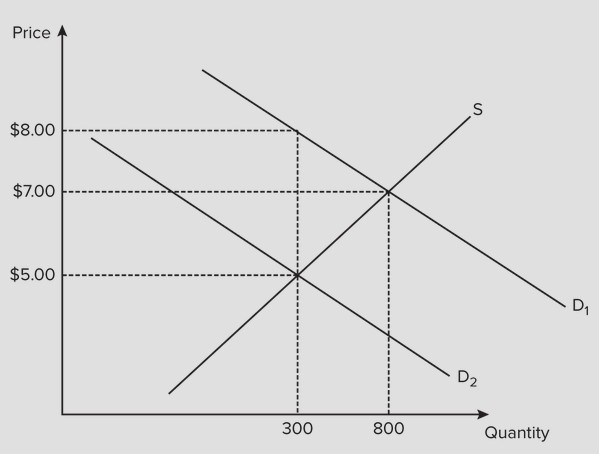

Use the following graph for a competitive market to answer the question below. Assume the government imposes a $3 tax on buyers, which results in a shift of the demand curve from D1 to D2. The government's tax revenue is

Assume the government imposes a $3 tax on buyers, which results in a shift of the demand curve from D1 to D2. The government's tax revenue is

A. $900.

B. $2,100.

C. $2,400.

D. $600.

Answer: A

You might also like to view...

How do firms estimate the demand for labor?

What will be an ideal response?

A firm’s price is

A. greater than average revenue. B. greater than marginal revenue. C. less than marginal cost. D. equal to average revenue.

A year ago a country reduced the tax rate on all interest income from 40% to 10%. During the year private saving was $600 billion as compared to $500 billion the year before the tax reform. Taxes collected on interest income fell by $150 billion. Assuming no other changes in government revenues or spending which of the following is correct?

a. the substitution effect was larger than the income effect; national saving rose b. the substitution effect was larger than the income effect; national saving fell c. the income effect was larger than the substitution effect; national saving rose d. the income effect was larger than the substitution effect; national saving fell

The following provides data for an economy in a certain year. Consumption expenditures$50Imports$40Government purchases of goods and services$20Construction of new homes and apartments$30Sales of existing homes and apartments$40Exports$50Government payments to retirees$10Household purchases of durable goods$20Beginning-of-year inventory$10End-of-year inventory$20Business fixed investment$30Given the data, compute the value of GDP.

A. $140 B. $160 C. $130 D. $150