The more inelastic the demand for a product, the more the actual burden of a tax on the product will:

A. fall on sellers.

B. fall on buyers.

C. fall equally on both buyers and sellers.

D. create a larger deadweight loss (or excess burden).

Answer: B

You might also like to view...

An economic variable that moves in the same direction as aggregate economic activity (up in expansions, down in contractions) is called

A) procyclical. B) countercyclical. C) acyclical. D) a leading variable.

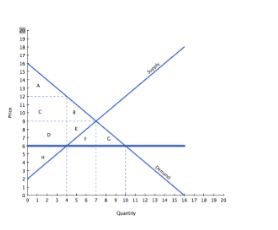

With reference to the graph above, if the intended aim of the price ceiling shown was a net increase in the well-being of consumers, then positive analysis would conclude:

A. the policy was effective, since area A + C is larger than B + D.

B. the policy was effective, since area B is smaller than area D.

C. the policy was ineffective, since D is larger than E.

D. the policy was ineffective, since A + C + D is larger than B + E.

It has been argued that state-subsidized ____ programs have benefited the middle and upper-income quintiles more than the poor

a. food stamp b. housing subsidy c. higher education d. Medicaid

Which of the following is an important aspect of rational self-interest?

a. considering future costs b. considering past costs c. considering future causes d. considering past causes