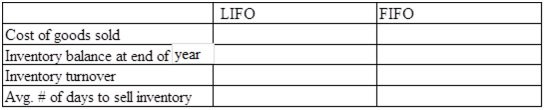

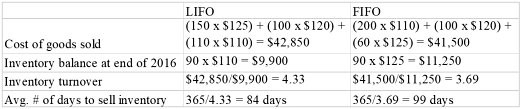

The following information relating to the current year was taken from the records of Poole Company: Beginning inventory200 units @ $110Purchase May 12100 units @ $120Purchase October 9150 units @ $125Sales360 units @ $180Required: a) Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year. b) Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory. c) Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year. d) Based on your results from part (c), calculate inventory turnover and average number of

days to sell inventory. e) Compare your results from parts (b) and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

What will be an ideal response?

a) | through d) |

b)

You might also like to view...

Jose is married filing a joint return. In 2019, he earned $160,000 of profit from his sole proprietorship, which operates a service business. The business paid no W-2 wages in 2019 and owns no tangible business property.a. Compute Jose's allowable QBI deduction if his joint return reflects taxable income of $300,000 before the deduction. b. Compute Jose's allowable QBI deduction if his joint return reflects taxable income of $340,000 before the deduction.

What will be an ideal response?

Which of the following does a company use to decide the relative positions of its competitors

when using the market structure method of competition identification? A) product range B) market share C) brand reputation D) annual revenue

According to the text, a management contract is useful for

A. earning money by branding. B. joint ventures and wholly owned subsidiaries. C. import stimulation in the host country. D. turnkey projects.

When RedBox rents DVD movies from vending machines at McDonald's, it is acting as a channel captain, not a retailer.

Answer the following statement true (T) or false (F)