Assume that foreign capital flows into a nation rise due to expected increases in stock market appreciation. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds per time period and monetary base in the context of the Three-Sector-Model?

a. The quantity of real loanable funds rises and monetary base

rises.

b. The quantity of real loanable funds rises and monetary base falls.

c. The quantity of real loanable funds and monetary base fall.

d. The quantity of real loanable funds and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

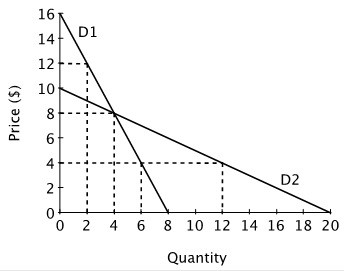

Refer to the figure below. When the price is equal to 8, the price elasticity of demand for the demand curve D1 is ________ and for D2 the price elasticity of demand is ________.

A. 1; 4 B. 4; 1 C. 2; 4 D. 4; 4

The textbook notes that the last time a major league batter hit .400 was in 1941. This is because:

A. the league imposes harsh penalties for steroid use. B. baseball diamonds have become larger. C. the average quality of batters has fallen. D. specialization by pitchers, infielders, and outfielders has made it harder for batters to hit.

In developing countries, exchange rates tend to be

A) floating with some government intervention. B) pegged. C) hard to tell from the data. D) run by currency boards. E) flexible.

The current structure of financial markets can be best understood as the result of attempts by financial market participants to

A) adapt to continually changing government regulations. B) deal with the great number of small firms in the United States. C) reduce transaction costs. D) cartelize the provision of financial services.