If a point lies on the monetary policy reaction curve, and at this point the inflation rate equals the target rate of inflation, we know that:

A. the real interest rate corresponding to this point is below the long-run real interest rate.

B. current output is above potential output.

C. the real interest rate corresponding to this point is equal to the long-run real interest rate.

D. the real interest rate corresponding to this point is above the long-run real interest rate.

Answer: C

You might also like to view...

Which of the following are NOT included among Gordon's criticisms of Friedman's fooling model?

A) Workers buy many goods on a weekly basis and thus could discover quite quickly that prices had risen. B) Workers could discover movements in the aggregate price level fairly easily. C) The model relied on a non-market-clearing explanation of the labor market. D) Workers would predict higher prices if policies that led to higher prices in the past were used again.

The Fed's policy decisions have an important influence on

a. inflation in the long run and employment and production in the short run. b. inflation in the long run and employment and production in the long run. c. inflation in the short run and employment and production in the short run. d. inflation in the short run and employment and production in the long run.

A strike

A. hurts the firm's management and shareholders but not the union members. B. is always in the firm's best interest. C. is never in the best interest of the rank and file. D. can be a rational response during the union-firm negotiation process. E. is a Pareto optimal outcome.

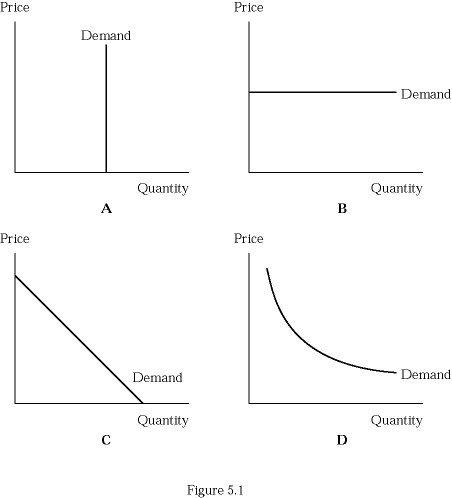

In Figure 5.1, the demand curve along which price elasticity of demand changes as you move along it is on graph:

In Figure 5.1, the demand curve along which price elasticity of demand changes as you move along it is on graph:

A. A. B. B. C. C. D. D.