A tax specialist has estimated the probability that a tax return selected at random will be audited is .06. Furthermore, he estimates the probability that an audited return will result in additional assessments being levied on the taxpayer is .50.

What is the probability that a tax return selected at random will result in additional assessments being levied on the

taxpayer?

a. 0.023

b. 0.041

c. 0.037

d. 0.03

d. 0.03

Mathematics

You might also like to view...

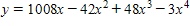

What is the maximum value of

A.

B. ?

C. ?

D. There is no solution.

Mathematics

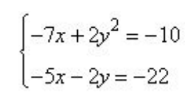

Determine which ordered pair is a solution of the system.

A) (6, –4)

B) (–7, 1)

C) (–7,–3)

D) (–4, –6)

E) (6, 4)

Mathematics

Find the probability.A 6-sided die is rolled. What is the probability of rolling a 3 or a 6?

A. 2

B.

C.

D.

Mathematics

Approximate the value of the square root, rounded to the indicated place. to 3 decimal places

to 3 decimal places

A. 28.448 B. 809.000 C. 28.443 D. 28.440

Mathematics