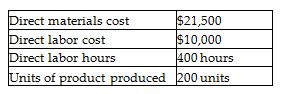

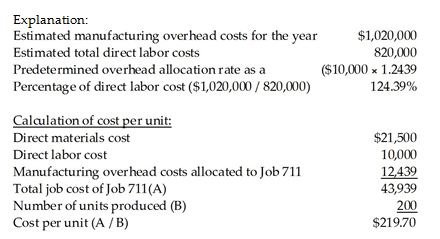

Irene Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, the company estimated total manufacturing overhead costs at $1,020,000 and total direct labor costs at $820,000. In June, Job 711 was completed. The details of Job 711 are shown below.

How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent.)

A) $157.50

B) $197.70

C) $169.70

D) $219.70

D) $219.70

You might also like to view...

The typical response is referred to as the central tendency

Indicate whether the statement is true or false

Volume maximization is the same thing as survival pricing.

Answer the following statement true (T) or false (F)

The deliverable from the focus step of the project risk analysis and management model is:

A) A clear, unambiguous, shared understanding of all key aspects of the project documented, verified, and reported. B) A clear, unambiguous, shared understanding of all relevant key aspects of the RMP documented, verified, and reported. C) A clear understanding of the implications of any important simplifying assumptions about relationships between risks, responses and base plan activities. D) Clear ownership and management allocations, effectively and efficiently defined, legally enforceable in practice where appropriate.

The __________ requires that officers and directors not take personal advantage of a desirable business investment that rightfully belongs to the corporation

a. right of first refusal b. corporate opportunity doctrine c. line of business test d. expectancy test