Forward guidance is:

A. statements today about policy targets in the future.

B. statements of policy changes and dates those changes will take effect.

C. asset purchases that shift the composition of the Fed's balance sheet.

D. expansion of the supply of aggregate reserves beyond the amount needed to maintain the policy rate target.

Answer: A

You might also like to view...

Suppose the annual rate of interest is r%. Which of the following statements is then true of the future value of $1,000 for a time of T years?

A) Irrespective of whether the sum of $1,000 is borrowed or lent, the future value in both cases will equal (1 - r)T × (1,000). B) Irrespective of whether the sum of $1,000 is borrowed or lent, the future value in both cases will equal (1 + r)T × (1,000). C) If $1,000 is borrowed, the future value will equal (1 + r)T × (1,000), but if it is lent out, the future value will equal (1 - r)T × $1,000. D) If $1,000 is borrowed, the future value will equal (1 - r)T × (1,000), but if it is lent out, the future value will equal (1+ r)T × $1,000.

The basic money supply:

A. Is controlled by Congress and the U.S. Treasury. B. Includes savings accounts. C. Includes currency and transactions accounts. D. Includes money market mutual funds.

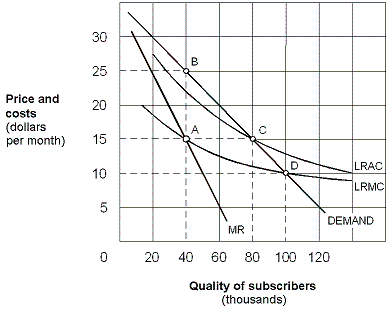

Exhibit 13-1 Cable television monopolist

A. A. B. B. C. C. D. D.

An effective price ceiling will be set above the equilibrium price.

Answer the following statement true (T) or false (F)