If policymakers use a pollution tax to control pollution, the tax per unit of pollution should be set

A) equal to the marginal private cost of production at the economically efficient level of pollution.

B) equal to the amount of the deadweight loss created in the absence of a pollution tax.

C) at a level low enough so that producers can pass along a portion of the additional cost onto consumers without significantly reducing demand for the product.

D) equal to the marginal external cost at the economically efficient level of pollution.

D

You might also like to view...

The high-income nations of the world—including the United States, Canada, the Western European countries, and Japan—typically have GDP per capita in the range of _____________.

a. $6,000 to $12,000 b. $20,000 to $50,000 d. $60,000 to $80,000 d. $80,000 to $120,000

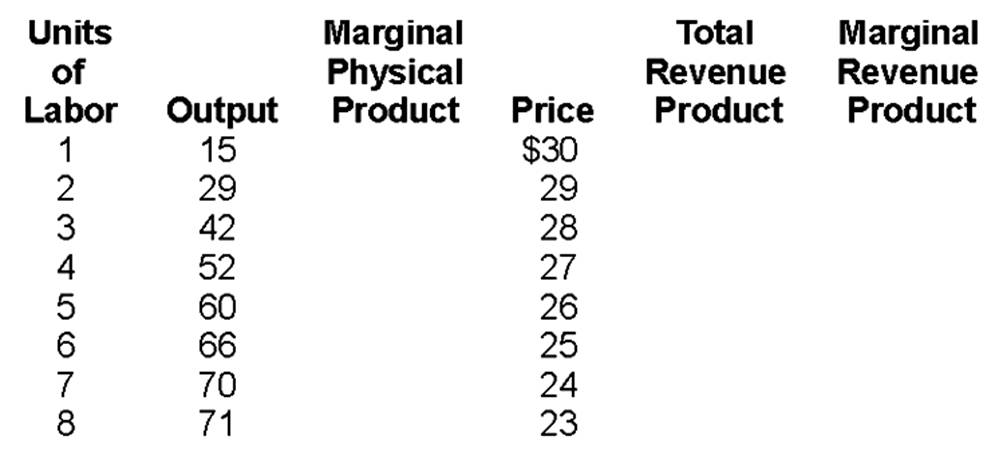

If the wage rate were $90, how many workers would be hired?

The law of diminishing marginal productivity implies that opportunity cost:

A. is constant as all inputs are increased to produce successive units of output. B. increases as all inputs are increased to produce successive units of output. C. increases as one input is increased to produce successive units of output. D. is constant as one input is increased to produce successive units of output.

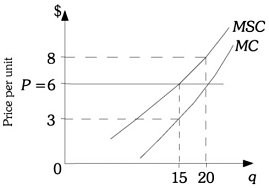

Refer to the information provided in Figure 16.3 below to answer the question(s) that follow.  Figure 16.3Refer to Figure 16.3. At 15 units of output there are external ________ per unit.

Figure 16.3Refer to Figure 16.3. At 15 units of output there are external ________ per unit.

A. costs of $0 B. costs of $6 C. benefits of $2 D. benefits of $8