A(n) ________ is a tax on an imported good.

A. tariff

B. import quota

C. voluntary export restraint (VER)

D. export quota

Answer: A

You might also like to view...

An “opportunity cost” may be described as

A. the value of what must be given up. B. the opportunity foregone. C. the value of the next best alternative. D. the correct measure of cost. E. All of these responses are correct.

US law was recently changed so that some airplane manufacturers are immune from liability from accidents involving their decades old aircraft. As a result

a. accident rates fell due to less adverse selection b. accident rates fell due to less moral hazard c. accident rates rose due to less adverse selection d. accident rates rose due to less moral hazard

The opportunity cost of going to college full time away from home includes

A. the time you could have spent with parents back home. B. the funds you would have saved if you had not paid the tuition. C. the income you could have earned from a full-time job. D. All of these are correct.

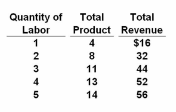

Refer to the given data. The marginal revenue product of the second worker is:

A. $16.

B. $32.

C. $8.

D. $4.