Auditing standards provide guidance for auditors when evaluating electronic evidence. What are the implications for an auditor when a client’s accounting system produces and stores transaction evidence only electronically?

What will be an ideal response?

Paragraph A134 of AU-C Section 315, “Understanding the Entity and Its Environment and Assessing the

Risk of Material Misstatement”, summarizes the implications as follows:

"When such routine business transactions are subject to highly automated processing with little or no manual

intervention, it may not be possible to perform only substantive procedures in relation to the risk. For example,

the auditor may consider this to be the case when a significant amount of an entity's information is initiated,

authorized, recorded, processed, or reported only in electronic form, such as in an integrated system. In such

cases

- audit evidence may be available only in electronic form, and its sufficiency and appropriateness

usually depend on the effectiveness of controls over its accuracy and completeness.

- the potential for improper initiation or alteration of information to occur and not be detected may be

greater if appropriate controls are not operating effectively."

You might also like to view...

Each of the following transactions would be classified as either an investing or a financing activity except

a. investments in stock are purchased. b. a bank loan is obtained. c. stock is issued to acquire land. d. dividends are paid.

The study of ethics goes no further than the requirements of the law to evaluate what is right for society.

Answer the following statement true (T) or false (F)

When a corporation owns more than 50 percent of the voting stock in another corporation, it usually should report its investment by using (the)

a. equity method. b. cost adjusted to market method. c. book value method. d. consolidated financial statements.

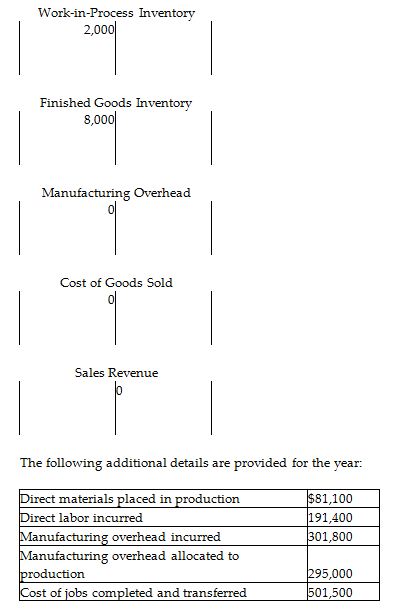

At the beginning of the year, Tea Tree Manufacturing had the following account balances:

The unadjusted balance in the Manufacturing Overhead account is a ________.

A) credit of $295,000

B) credit of $6800

C) debit of $6800

D) debit of $301,800