Of the following methods that banks might use to reduce moral hazard problems, the one not legally permitted in the United States is the

A) requirement that firms keep compensating balances at the banks from which they obtain their loans.

B) requirement that firms place on their board of directors an officer from the bank.

C) inclusion of restrictive covenants in loan contracts.

D) requirement that individuals provide detailed credit histories to bank loan officers.

B

You might also like to view...

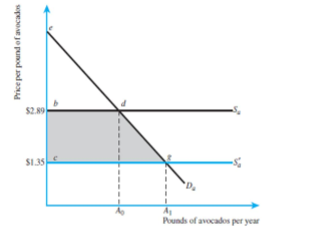

Refer to the figure below. If the demand curve can be characterized by the equation Q = 10 - P, how much increase in consumer surplus will occur when the price of avocados falls from $2.89 to $1.35?

The Federal Deposit Insurance Corporation:

A. has eliminated bank failures. B. insures all demand deposits without limit. C. insures all demand deposits up to $250,000. D. includes commercial banks and state-chartered banks as its members.

The fact that output gaps will not last indefinitely, but will be closed by rising or falling inflation is the economy's:

A. income-expenditure multiplier. B. self-correcting property. C. short-run equilibrium property. D. long-run equilibrium property.

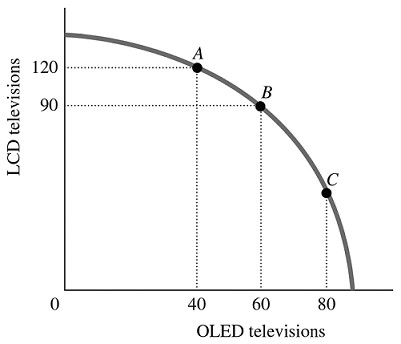

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

A. more than 30. B. exactly 60. C. fewer than 30. D. exactly 30.