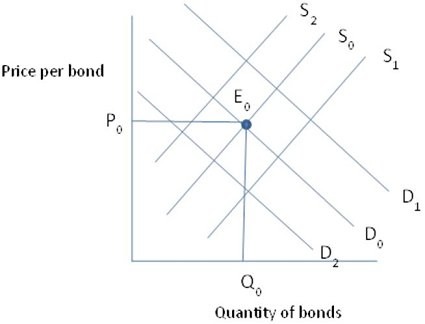

The market for bonds is initially described by the supply of bonds - S0, and the demand for bonds - D0,with the equilibrium price and quantity being P0 and Q0. If the U.S. government's borrowing needs decrease, all other factors constant:

A. Bond supply curve to shift to S1

B. Bond demand curve to shift to D1

C. Bond demand curve to shift to D2

D. Bond supply curve to shift to S2

Answer: D

You might also like to view...

In the IS-LM model, equilibrium income can be affected by

A) fiscal policy alone. B) monetary policy alone. C) both fiscal and monetary policy. D) neither monetary nor fiscal policy.

When OPEC cut energy production in 1973, the aggregate supply curve shifted outward

a. True b. False Indicate whether the statement is true or false

According to the rational expectations theory, expansionary monetary policy will

a. reduce inflation. b. lead to inflation and the higher rate of inflation will be quickly anticipated. c. reduce unemployment because people will generally underestimate the inflationary side effects of the monetary expansion. d. accelerate inflation in the short run, but in the long run the primary effect will be an increase in employment.

During the Great Recession, the growth rate of Real GDP _________________ and the inflation rate ___________________

A) increased; declined B) declined; increased C) declined; also declined D) increased; also increased