If an exempt organization conducts a trade or business that is regularly carried on by the organization when the business relates to the organization's exempt purpose, the organization is subject to the unrelated business income tax (UBIT).

Answer the following statement true (T) or false (F)

False

Rationale: For an exempt organization to be subject to the UBIT, all of the following conditions must be present.? The organization conducts a trade or business.? The trade or business is not substantially related to the exempt purpose of the organization.? The trade or business is regularly carried on by the organization.

You might also like to view...

How does the Better Business Bureau differ from Rotary International?

a. It puts a greater focus on improving the local community. b. It is international instead of domestic. c. It is more focused on improving business conduct than community service projects. d. There is less networking between business members.

"Proximity" or closeness implies that a firm should locate "close" to something

What are the three kinds of proximity described in the text? What are the basic conditions under which each is appropriate? What kinds of firms are likely to use each of these?

What is service-oriented architecture?

What will be an ideal response?

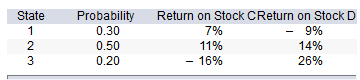

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

Consider the following probability distribution for stocks C and D:

A. 9.891%; 8.70%

B. 9.945%; 11.12%

C. 8.225%; 8.70%

D. 10.275%; 11.12%