Compute the arithmetic mean of the following numbers: 44, 66, 67, 23, 24 (Round your answer to one decimal place)

A. 44.0

B. 44.8

C. 40.0

D. 31.4

Answer: B

You might also like to view...

For the year ending December 31, 2018, the RJ Corporation reported book income before taxes of $579,000. During 2018: RJ's book depreciation expense was $25,000 greater than what was allowed for tax purposes due to a reversing difference; RJ accrued $17,750 of warranty expense which is not deductible for tax purposes until 2019; RJ recognized a $29,000 unrealized loss on an investment which is not deductible for tax purposes until the investment is sold; and RJ's book income included municipal bond interest of $19,500. What was RJ Corporation's 2018 income tax expense assuming a tax rate of 40%?

A. $232,500 B. $252,500 C. $215,100 D. $243,800

In which of the following situations will the book value of a bond be equal to its maturity value?

A) The effective rate exceeds the stated rate. B) The nominal rate exceeds the yield rate. C) The market rate equals the contract rate. D) The effective rate equals the yield rate.

A stock split normally increases total stockholders' equity

Indicate whether the statement is true or false

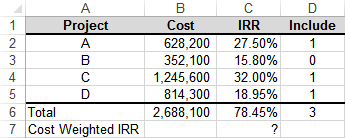

In column D, a 1 indicates that the project will be selected and a 0 otherwise. If you want to find the cost weighted average IRR of just those projects that are selected, which array formula in B7 would be correct?

a) =SUM(B2:B5 *$D2:$D5)/B6

b) {=SUM(B2:B5/B6*C2:C5*$D2:$D5)}

c) =SUM(B2:B5/B6*C2:C5*$D2:$D5)

d) {=SUM(B2:B5/B6*$D2:$D5) }