Crowding out can best be defined as

a. higher interest rates caused by restrictive monetary policy, which reduces investment.

b. higher interest rates caused by restrictive monetary policy, which increases saving and reduces consumption spending.

c. government budget deficits causing a drop in private borrowing because of higher interest rates.

d. government budget deficits causing a drop in interest rates, which reduces private saving.

c

You might also like to view...

The application of Solow's growth theory to the explanation of the slowdown in productivity growth in the United States suggests that the slowdown is primarily caused by

A) reduced growth in the capital stock per hour of work. B) reduced growth in the technical change or total factor productivity. C) slow residual growth of the capital stock. D) ignorance since people save and invest less.

Refer to Figure 9.3. If the market is in equilibrium, the consumer surplus earned by the buyer of the 100th unit is

A) $0.50. B) $0.75. C) $1.50. D) $2.00. E) $2.75.

If the coupon payment on a bond is $640 and the coupon rate is 6%, then what is the face value of the bond?

A) $10,667 B) $10,000 C) $1,067 D) $678.40 E) There is not enough information provided to answer this question.

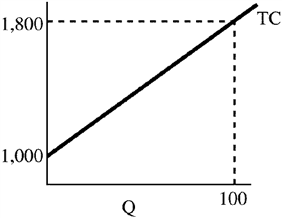

Figure 7-7

In Figure 7-7 at 100 units, AVC equals

a.

8.

b.

800.

c.

100.

d.

1,000.