How does SOX affect the provision of attest and advisory services

What will be an ideal response?

Prior to the passage of SOX, accounting firms could provide advisory services concurrently to audit (attest function) clients. SOX legislation, however, greatly restricts the types of non-audit services that auditors may render audit clients. It is now unlawful for a registered public accounting firm that is currently providing attest services for a client to provide the following services: bookkeeping or other services related to the accounting records or financial statements of the audit client, financial information systems design and implementation, appraisal or valuation services, fairness opinions, or contribution-in-kind reports, actuarial services, internal audit outsourcing services, management functions or human resources, broker or dealer, investment adviser, or investment banking services, legal services and expert services unrelated to the audit, or any other service that the board of directors determines, by regulation, is impermissible.

You might also like to view...

Cycle Sales Company offers warranties on all their bikes. They estimate warranty expense at 3.5% of sales. At the beginning of 2019, the Estimated Warranty Payable account had a credit balance of $1400. During the year, Cycle Sales had $299,000 in sales and had to pay out $5900 in warranty payments. How much Warranty Expense will be reported on the 2019 income statement?

A) $5965 B) $7300 C) $9065 D) $10,465

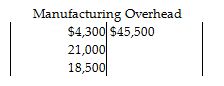

Metropolitan Enterprises reports the following information at December 31:

Requirements

1. What is the actual manufacturing overhead of Metropolitan Enterprises?

2. What is the allocated manufacturing overhead?

3. Is manufacturing overhead underallocated or overallocated? By how much?

The backward pass ______.

A. starts at the end of the project B. moves toward the last node in the project C. ends at the middle node in the project D. starts at the beginning of the project

The city of Granby, Colorado, recently enacted a 1.5 percent surcharge on vacation cabin rentals that will fund the city's new elementary school. This surcharge is an example of ________.

A. a sin tax to discourage undesirable behavior B. a government fine C. a sin tax to discourage undesirable behavior and an earmarked tax D. an earmarked tax E. None of the choices are correct