Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:

Firm B cuts Firm B colludes

Firm A cuts 6,6 24,8

Firm A colludes 8,24 12,12

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

A) Both firms cut prices.

B) Both firms collude.

C) There are two Nash equilibria: A cuts and B colludes, and A colludes and B cuts.

D) There are no Nash equilibria in this game.

C

You might also like to view...

The goal of the perfectly competitive firm is to

A) maximize total revenue. B) maximize total profits. C) minimize AFC. D) minimize ATC.

How are the insurance premiums determined for deposit insurance?

a. The insurance premium is based on the bank’s level of deposits and then adjusted according to the riskiness of a bank’s financial situation. b. The insurance premium is based on the bank’s level of riskiness and then adjusted according to the bank’s level of deposits. c. The insurance premium is based on the bank’s level of deposits and then adjusted according to the riskiness of the overall U.S. banking system's financial situation. d. The insurance premium is based on the bank’s level of riskiness and then adjusted according to the level of deposits of the overall U.S. banking system.

All students should go on to college.

A. True B. False C. Uncertain

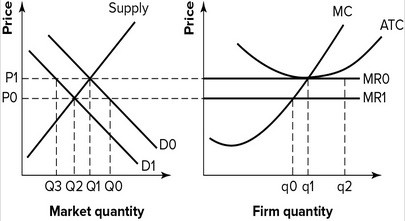

Refer to the graphs shown, which depict a perfectly competitive market and firm. If market demand decreases from D0 to D1:

A. market price remains at P0 because perfectly competitive firms can't earn positive economic profit. B. the firm's output remains at q1 because perfectly competitive firms can't earn positive economic profit. C. market price falls from P0 to P1 and the firm's output rises from q0 to q1. D. market price falls from P0 to P1 and the firm's output falls from q1 to q0.