The marginal income tax rate is equal to

A) the total tax payment divided by total income.

B) the change in the tax payment divided by the change in income.

C) the average tax payment divided by the total tax payment.

D) the percent of total income that goes to taxes.

B

You might also like to view...

In a certain economy, the components of aggregate spending are given by: C = 500 + 0.75(Y - T) - 500rI = 300 - 500rG = 400NX = 30T = 40 Given the information about the economy above, which expression below gives autonomous expenditures?

A. [1,230 - 1,000r] B. [1,200 - 1,000r] C. [1,200 - 1,000r] + 0.75Y D. [1,270 - 1,000r] + 0.75Y

Tonya, who is rich, and Jerome, who is poorer, both buy orange juice and croissants for lunch at the student cafeteria. Their budget constraints on a diagram with orange juice on the vertical axis and croissants on the horizontal have the same

A) horizontal intercepts. B) vertical intercepts. C) slopes. D) midpoints.

The majority of Medicaid dollars goes to poor families with children

Indicate whether the statement is true or false

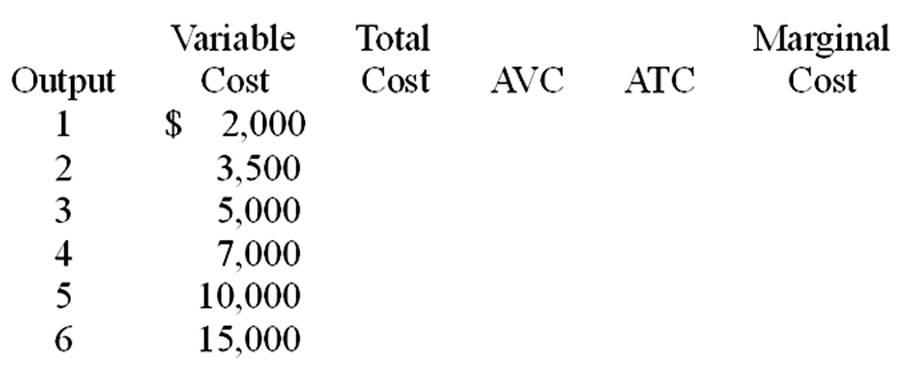

Fill in the table. Assume the fixed cost is $2,000.