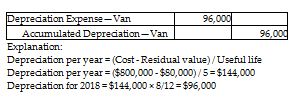

George Company purchased a van on May 1, 2018, for $800,000. Estimated life of the van was five years, and its estimated residual value was $80,000. George uses the straight-line method of depreciation. Prepare the journal entry to record the depreciation expense for 2018 on the van. Omit explanation.

What will be an ideal response?

Business

You might also like to view...

______refers to a statement or declaration by a person who has a connection to the topic.

a. Testimony b. An example c. A statistic d. Evidence

Business

The goal of relationship marketing is to gain additional customers

Indicate whether the statement is true or false

Business

The primary functions of an investment asset are to increase your net worth and/or provide additional income

Indicate whether the statement is true or false.

Business

The center-of-gravity method is used primarily to determine what type of locations?

A) service locations B) manufacturing locations C) distribution center locations D) supplier locations E) call center locations

Business