Banks and customers are most likely to be reluctant to use the full lending capacity made available by the Federal Reserve when the economy experiences

A. High inflation rates.

B. A deep recession.

C. Growth and low interest rates.

D. Growth and inflation rates higher than the interest rate.

Answer: B

You might also like to view...

Virtual currency unit 2 (VCU2) is different from VCU1 because:

a. VCU1 cannot be spent in the real world; VCUs can be spent in the real world. b. In terms of convertibility, there is no difference; both VCU2 and VCU3 can be purchased with and sold for legal tender. c. VCU2 can directly affect real world demand, whereas VCU1 cannot affect real-world demand. d. In terms of their potential to change a nation's monetary base, there is no difference because neither VCU1 nor VCU2 affect a nation's monetary base.

The Federal Reserve System consists of which of the following?

Federal Deposit Insurance Corporation and Controller of the Currency U.S. Treasury Department and Bureau of Engraving and Printing Federal Open Market Committee and Office of Thrift Supervision Board of Governors and the 12 Federal Reserve Banks

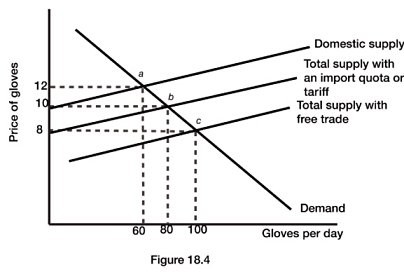

Refer to Figure 18.4. With an import ban, what is the equilibrium price of gloves in Duckland?

Refer to Figure 18.4. With an import ban, what is the equilibrium price of gloves in Duckland?

A. $0 B. $8 C. $9 D. $12

When an economy is operating efficiently, which is TRUE?

A. All resources are fully employed. B. Resources are not fully employed or current technology is not being fully utilized. C. It would be possible to increase the output of 1 good without decreasing the output of the other. D. This economy is operating to the right of its production possibilities curve (PPC).