Imposing a tax on sales of a product

A) shifts the market demand curve for the product.

B) shifts the market supply curve for the product.

C) shifts both the market supply and demand curve for the product.

D) has no effect on either the market demand or the market supply curve for the product.

B

You might also like to view...

Who among the following benefits from inflation?

a. Patrick Roy who borrowed $10,000 from a bank to pay the downpayment on a house he bought in Denver b. The Denver National Bank who provided Patrick Roy with the $10,000 to make the downpayment c. Jerry Swanson, a landlord who holds a 5-year lease on an apartment rented to students off campus at the University of Arizona d. Peter Schran who loaned Larry Neal $500 without charging Larry any interest e. Ian McDonald who is retired and lives on his $700 per week pension

High energy prices in the 1970s created a ______.

a. positive supply shock b. negative supply shock c. period of deflation d. period of low unemployment

Suppose market demand and supply are given by Qd = 100 - 2P and QS = 5 + 3P. The equilibrium price is:

A. $19. B. $20. C. $15. D. $17.

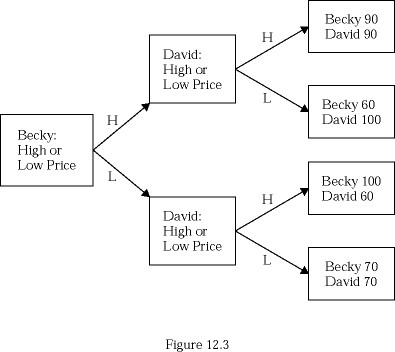

Consider Figure 12.3. Relative to the dominant strategy outcome, guaranteed price fixing would lead to:

Consider Figure 12.3. Relative to the dominant strategy outcome, guaranteed price fixing would lead to:

A. lower prices but higher profits. B. lower prices and lower profits. C. higher prices and higher profits. D. higher prices and lower profits.